07 Feb Decoding Tulsa Mortgage Rates: Your OMG Guide to Making Sense of the Market

Hey there, Tulsa house hunters and homeowners! 👋

Let’s discuss the topic that’s probably on most people’s minds these days: Tulsa mortgage rates. We know they’ve been a bit of a rollercoaster lately, and that can make figuring out how much house you can afford a real headache.

First, some quick facts: Tulsa Rates have been going up and down a bit, and that’s because, well, a lot of things affect them. The overall economy, the job market, inflation – it’s like a big pot of financial soup, and all the ingredients can influence the final rate.

But don’t worry, you don’t need a Ph.D. in economics to navigate this! That’s where we, the Tulsa mortgage pros at OMG, come in.

We’re here to discuss the trends, what experts say about the future, and, most importantly, how it all affects your Tulsa homeownership goals.

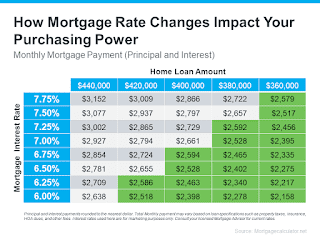

For example, this chart below shows how even a small change in the Tulsa interest rates can significantly affect how much house you can afford. See the green area? That shows the range of monthly payments (around $2,500 to $2,600) you could qualify for depending on the rate. Pretty cool, right?

The bottom line is, we know navigating the Tulsa mortgage market can be confusing. That’s why we’re here to help! If you’re thinking about buying a home in Tulsa or refinancing your current mortgage, give us a shout at Oklahoma Mortgage Group (OMG). We’ll walk you through everything and make sure you get the best possible interest rate for your situation. Click here to book a phone chat with us today to discuss the best next steps or feel free to call or text us at 918-236-2942.

Let’s get you in your dream home in Tulsa (or save you money on your current one)!

P.S. Rates are currently over 7% in Tulsa, but that can always change. We’ll keep you posted on any major trends. In the meantime, feel free to reach out to us with any questions!

No Comments