03 Apr What’s Actually Going on with Mortgage Rates

Understanding the Dynamics of Tulsa Mortgage Rates

Navigating the landscape of Tulsa mortgage rates can sometimes feel like trying to read a complex puzzle. You may come across a piece of information suggesting that Tulsa interest rates are on a downward trend, only to encounter another source claiming they’re on the rise again. This oscillation can leave many Tulsa residents puzzled about the actual state of mortgage rates.

The truth of the matter lies in the timeframe being considered. To demystify the fluctuating Tulsa mortgage rates, here’s what you need to know.

The Inherent Volatility of Mortgage Rates

Mortgage rates are inherently unstable, influenced by a myriad of factors including economic indicators, Federal Reserve decisions, and global events, to name a few. This results in rates that may increase one day and decrease the next, mirroring the dynamic nature of the economic environment.

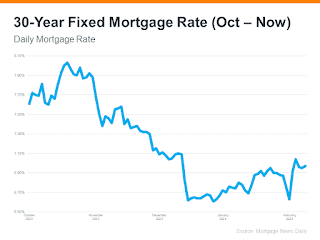

By examining historical data from Mortgage News Daily on the 30-year fixed mortgage rate, we observe significant fluctuations over time, illustrating the unpredictable journey of mortgage rates.

Interpreting the Data

The interpretation of mortgage rate trends can vary significantly depending on the specific points in time being compared. For instance, a short-term analysis might suggest an upward trajectory in rates. However, a broader comparison, such as from a peak in October to the most recent data, may indicate a general decrease in rates.

Focusing on the Bigger Picture

To truly grasp the movement of Tulsa mortgage rates, it’s essential to zoom out and consider the broader trend rather than getting lost in the minutiae of daily fluctuations. A comparison of rates from their peak last October to their current state reveals a general decline, which is positive news for potential homebuyers in Tulsa.

Experts tend to agree that, despite short-term volatility, the overarching trend may continue to favor lower Tulsa mortgage rates in the coming year.

Conclusion

If you’re feeling overwhelmed by the varying reports on Tulsa mortgage rates, remember that the key to understanding lies in the broader perspective. For those in the Tulsa area, whether you’re looking to buy a home or have questions about the current state of the housing market, connecting with the Oklahoma Mortgage Group can provide clarity and guidance. Let’s discuss how the latest trends in Tulsa mortgage rates can impact your home buying journey. Click here to book a phone chat today to discuss more or call/text anytime: 918-236-2942!

Location: Tulsa, OK, USA

No Comments