03 Apr Tulsa Mortgage Rates Reach a New 7-Month Low: Insights on Tulsa Home Loans

In the dynamic world of Tulsa mortgages, a significant yet subtle shift has occurred, marking a moment of stability in an otherwise fluctuating market. For the first time in a week, we’ve seen mortgage rates move by a normal amount, breaking the pattern of the calmest, flattest seven days in over a year. This stability, though not particularly headline-grabbing, is a noteworthy change for those interested in Tulsa home loans.

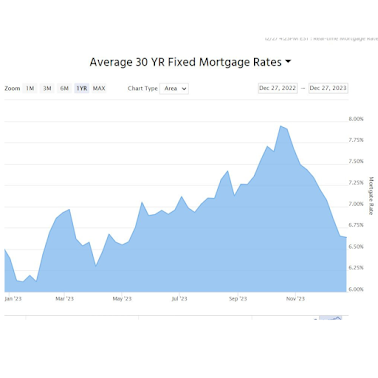

Delving deeper into today’s mortgage landscape, we find that Tulsa’s mortgage rates have hit their lowest point since May 2023. This milestone is undoubtedly a positive sign for potential homeowners and those considering refinancing in Tulsa. While these rates are indeed the lowest in over seven months, it’s important to note that the decrease is not significantly lower than what we’ve observed in the past two weeks. Essentially, the average mortgage borrower would likely receive a similar quote today as they would have on other recent days.

One intriguing aspect of today’s modest improvement over yesterday’s rates is the lack of direct correlation with economic data, news headlines, or scheduled events. This indicates a bond market, which significantly influences mortgage rates, operating beyond the usual data-dependent trends that have been prevalent in recent months. This independence suggests that we might also see moderate fluctuations in the opposite direction in the upcoming trading days.

For those in Tulsa looking into home loans or refinancing options, this period presents an interesting opportunity. The current stability and low rates could provide an advantageous moment to lock in a favorable rate. However, given the potential for upcoming fluctuations, staying informed and consulting with a mortgage expert is advisable to navigate these waters effectively.

In summary, Tulsa’s mortgage landscape is experiencing a period of notable calm and historically low rates, presenting unique opportunities for prospective borrowers. As always, staying informed and seeking expert advice is key to making the most of these developments in Tulsa’s home loan market.

Take Action Now: Don’t miss out on the opportunity to capitalize on these historic low mortgage rates in Tulsa. To learn more and explore your options, visit our website. Ready to dive deeper and discuss your specific needs and questions? Click here to book a phone chat with me now. Let’s navigate your mortgage journey together!

Location: Tulsa, OK, USA

No Comments