03 Apr Two Factors that Influence Mortgage Rates

As potential homeowners in Tulsa keenly observe the ever-evolving mortgage landscape, understanding the dynamics of Tulsa mortgage rates becomes paramount. In recent years, we’ve witnessed these rates plunge to historic lows, surge significantly, and now, they’re beginning to retreat slightly. But what drives these fluctuations? The factors at play are multifaceted and intricate, with inflation, the Federal Reserve’s strategies, and the 10-Year Treasury Yield playing pivotal roles.

Inflation and the Federal Reserve’s Influence

While the Federal Reserve (commonly referred to as the Fed) doesn’t set mortgage rates directly, its actions profoundly impact them. The Fed maneuvers the Federal Funds Rate in reaction to various economic indicators such as inflation, the overall economic climate, and employment statistics. As the Federal Funds Rate shifts, Tulsa mortgage rates tend to follow suit.

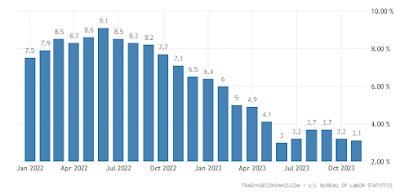

During recent years marked by heightened inflation, the Fed escalated the Federal Funds Rate, inadvertently driving mortgage rates upward. However, as Danielle Hale, Chief Economist at Realtor.com, anticipates, “Mortgage rates will continue to ease in 2024 as inflation improves.” The cooling inflation might even prompt the Fed to lower the Federal Funds Rate, aligning closer to their ideal target.

The Role of the 10-Year Treasury Yield

Tulsa mortgage lenders closely monitor the 10-Year Treasury Yield to determine appropriate interest rates for home loans. A rise in the yield generally leads to an increase in mortgage rates, and vice versa. While the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has traditionally been stable, recent fluctuations suggest potential for mortgage rates to decrease. Therefore, keeping a vigilant eye on the treasury yield’s trajectory can offer insights into future Tulsa mortgage rate movements.

The Bottom Line: Staying Informed and Prepared

As we anticipate the Fed’s upcoming meeting, industry experts and prospective homeowners alike are eagerly awaiting the decisions and their subsequent impact on the economy and Tulsa mortgage rates. In these times of change, aligning with a team of seasoned professionals is crucial. A knowledgeable Tulsa mortgage lender can provide the guidance and support necessary to navigate the complexities of Tulsa interest rates, ensuring you make informed decisions about your home-buying journey.

Understanding the influence of broader economic factors like the Federal Reserve’s decisions and the 10-Year Treasury Yield is essential in demystifying the ebb and flow of Tulsa mortgage rates. By staying informed and seeking expert advice, potential homeowners in Tulsa can adeptly navigate this fluctuating landscape, turning their dream of homeownership into a reality.

Click here to book a phone chat with me today to discuss this and your best next steps or feel free to call or text anytime: 918-361-1550.

Location: Tulsa, OK, USA

No Comments