28 Mar What Tulsa Homebuyers Need to Know About Credit Scores

A strong credit score is vital in the Tulsa mortgage process. It’s essential for securing Tulsa home loans at competitive rates. Your credit score is a metric used by Tulsa mortgage lenders to gauge your ability to repay borrowed money. Here’s what every Tulsa homebuyer should know about the components of a credit score:

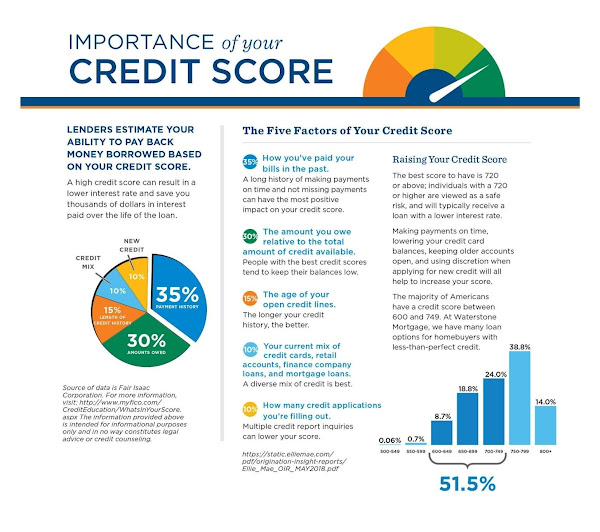

The Five Factors of Your Credit Score:

- Payment History (35%): This is about how consistently you’ve paid bills on time in the past. Maintaining a record of prompt payments is the most beneficial way to boost your score.

- Amounts Owed (30%): It’s crucial to manage the amounts you owe in relation to your total credit limit. Keeping low balances relative to your credit availability is key.

- Length of Credit History (15%): The length of time you’ve had credit goes a long way. A longer credit history can positively impact your score.

- New Credit (10%): Opening multiple new credit lines in a short period can be seen as riskier by lenders. It’s advisable to be cautious with how many credit applications you fill out.

- Credit Mix (10%): Having a variety of credit types, including credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans, is beneficial.

Raising Your Credit Score: The ideal credit score for obtaining a Tulsa mortgage is around 720 or above, though this isn’t a strict cutoff. Individuals with scores in this range are generally seen as low-risk by Tulsa mortgage lenders and typically qualify for lower interest rates. However, many Americans fall between the 600 and 749 range, and here at Oklahoma Mortgage Group, we offer Tulsa home financing options for a wide array of credit scores. Paying on time, managing credit balances, keeping older accounts open, and being selective about applying for new credit can all contribute to a higher score.

If you’re aiming to buy a home in Tulsa, understanding and improving your credit score is a powerful step toward securing favorable home financing. We offer a no-strings-attached credit game plan if you’re unsure of where your mortgage credit lies and would like a plan to get into your dream home. At OMG, we do whatever it takes to find a path to “yes”! Click here to book a phone chat with us so we can discuss best next steps. Or call/text me at 918-236-2942. Click here to go to our website and submit an application online so we can get started today on your credit game plan!

Sorry, the comment form is closed at this time.